Enjoy the convenience of applying for your cash advance online.

The Internet continues to change the way people do business, and just like you can look for just about any product or service online, you can even find a suitable cash advance there. Typical cash advance online loans require that you submit a simple online application, and if the lender approves your application you can receive the money in your bank account or via a check on the same or following business day.

You can apply for a cash advance even if you have poor credit history, which is a definite plus, but remember that you will still have to meet eligibility criteria as set by the lender.

How does taking out a cash advance work online?

Applying for a cash advance online requires that you choose a lender, which you can do on finder.com, and then submit your application. This process should take no more than a few minutes provided you have all the required information close at hand. Most providers inform you of the application’s status within a few minutes.

If you’re looking for a same-day cash advance online, know that you have limited options, because some lenders accept online applications and then allow you to collect approved funds in-store on that same day. Typically, cash advance online loans give you access to money the following business day when the money is transferred into your bank account.

What cash advance options are available?

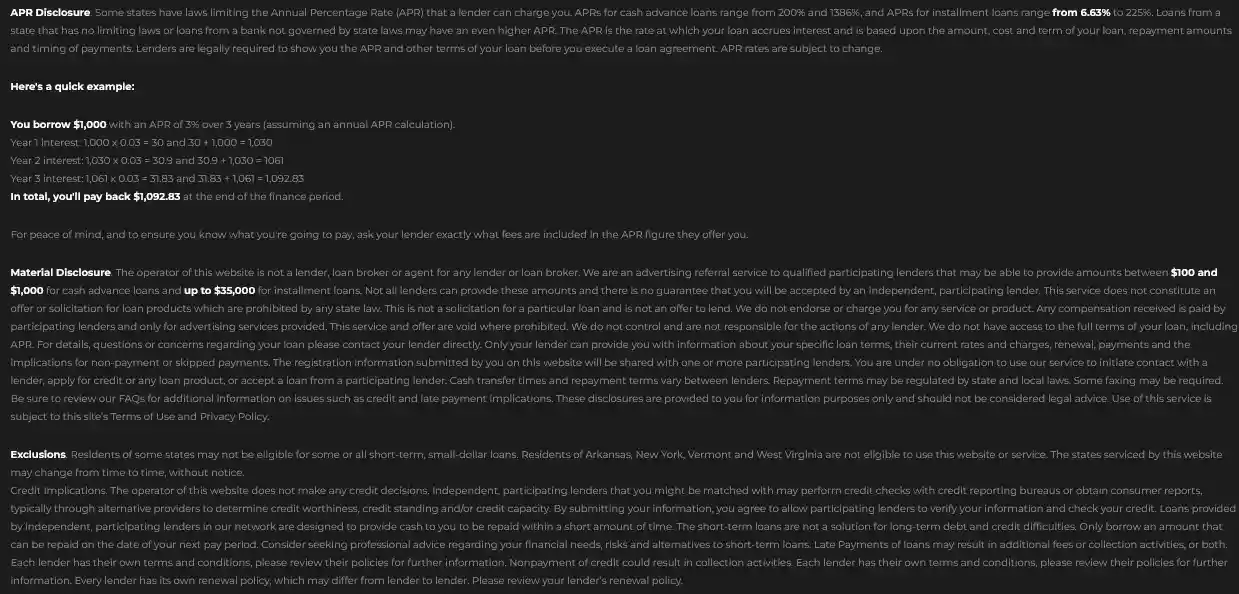

Cash advance loans. These loans are short- loans and can be applied for in-store or online. While the APR and fees will vary from state-to-state, keep in mind that they are generally quite high. Think carefully about whether you can afford your payday cash advance loan before you apply for it.

If you’re looking to apply for a cash advance, any of the following products might be an option to consider:

Credit card cash advance. If you have an existing credit card you can use it to get a cash advance. Remember that the cash advance fee, which can be either a flat fee or a percentage of the amount you withdraw from your card, can be quite high.

What features are on offer when I get cash online?

One way to get a cash advance that works for you is to go through cash advance online reviews. Comparing ones you shortlist is a good idea, and here are features that can help you narrow down your options:

A good cash advance provider should provide a user-friendly cash advance online application system, and such an application should take around five to 10 minutes to complete. Many lenders accept digital signatures on their loan contracts, further simplifying the process. Upon approval, you can look forward to the money being transferred into your bank account.

- Your choice of various store locations.

If you’re looking for a same-day cash advance online this aspect can help, because you can expect same day access to funds by visiting a store. Certain cash advance lenders have extensive store networks across the US, but you should also account for the proximity of a store from your home or office when you apply.

While state laws and the amount you borrow affect the fees you end up paying, lenders can charge loan fees differently, so make sure you don’t ignore this aspect.

- Lenders that accept bad credit.

While getting a conventional loan with bad credit history is not easy, you can consider applying for a cash advance online with bad credit as most lenders have slightly relaxed lending criteria.

Benefits and drawbacks of getting a cash advance online

What are the benefits?

You can apply for a cash advance online from just about anywhere, provided you have an internet enabled PC, laptop, or smartphone. State laws will apply in accordance with the residential address and other details you provide.

Depending on the lender you apply with and the time you apply, you could see the approved loan amount in your account in a matter of hours.

- Use the funds for any purpose.

Providers of online cash advances give you the freedom to do what you want with the approved funds, which you can use to repair a vehicle, pay bills, or put towards a seemingly worthy investment.

What are the drawbacks?

High fees.

Fees charged by cash advance providers are high, especially compared to standard loan products. It’s best to only use these for short-term financial solutions or when no other options are available.

Not available in all states.

Check what regulations are in place in your state to see whether you’ll be able to apply for one of these loans – some states have prohibited them completely.

What you should probably try to avoid

Applying for a cash advance online even when you know you may have trouble repaying it is a mistake, and one that you should definitely avoid. This is because non-payment of a cash advance can lead to collection activity, which in turn, could have an adverse effect on your credit score.

Avoid ignoring the loan’s terms and conditions which you can find in the loan’s contract, and this contract also gives you a clear indication of all the fees you may have to pay. Avoid repaying the loan late as there’s a very good chance you’ll end up paying additional fees.

Still need more information? Questions we frequently get asked.

How much can I borrow through cash advance online loans?

State laws have a bearing on the maximum you can borrow through a cash advance.

What eligibility criteria do I have to meet?

In most states, the minimum age for borrowers in 18 years. You should be a permanent resident or citizen of the United States, you should have a regular source of income, and you should have a valid checking account.

Why do I have to provide my bank account details?

When you apply for a cash advance online, your lender will transfer the approved funds into this account. On the due date, the lender will then request funds from the same account.

Will the lender call my employer?

Yes, you can expect your lender to call your employer, but this would be no more than a formal employment verification call.

Can I pay the loan off ahead of time?

Yes, you can, and in certain instances, you can even look forward to a refund of partial or complete loan fees.

Are there any hidden costs I should be aware of?

This could also vary from lender to lender. It’s important to read your loan contract to find out what the fees and charges are upfront.